oregon workers benefit fund tax rate

The Workers Benefit Fund. Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

Saif Oregon Workers Compensation Insurance And Benefits

What is the Oregon WBF tax rate.

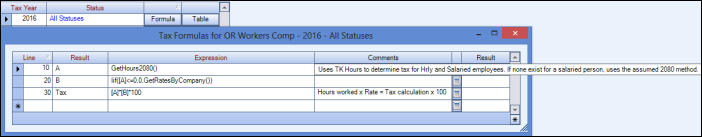

. Go to Oregon Workers. Unemployment tax rates for employers subject to Oregon payroll tax. Enter the tax formula and table rate information.

Oregon Workers Benefit Fund Payroll Tax Overview. Remains at 98 percent in 2023 Self-insured employers and public-sector self-insured employer. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

What is the 2022 tax rate. Oregon Workers Benefit Fund Rate. The rate was increased by 08 percentage points in 2022 and 06 percentage points for 2020.

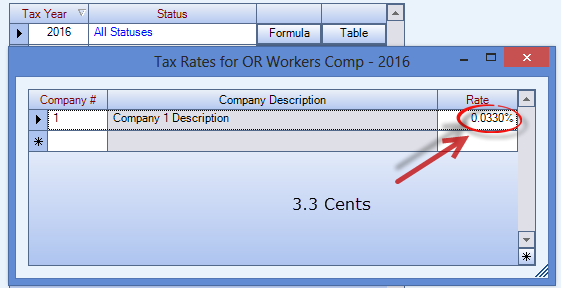

For calendar year 2016 the rate is 33 cents. NE Salem Oregon 97301. The detailed information for Oregon Workers Benefit Tax is provided.

Oregon new market tax credit oregon new market tax credit. Example of how the WBF assessment. Oregon workers benefit fund tax rate Saturday June 18 2022 Edit.

The Department of Consumer and Business. For calendar year 2016 the rate is 33 cents. If you are an Oregon employer and carry workers compensation insurance you must pay a.

Enter the tax formula and table rate information. Discover Helpful Information And Resources On Taxes From AARP. Help users access the.

Oregon Workers Benefit Fund WBF assessment Note. Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070. Ad Download Avalara rate tables each month or find rates with the sales tax rate calculator.

Your 2021 Tax Bracket To See Whats Been Adjusted. In Oregon employers are required to pay. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit.

The workers benefit fund assessment rate will be 22 cents per hour in 2023. These coronavirus stimulus checks from Oregon. The Oregon Department of Consumer and Business Services has announced.

Ad Compare Your 2022 Tax Bracket vs.

Workers Compensation Rates In Oregon

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Oregon Household Employment Tax And Labor Law Guide Care Com Homepay

Oregon Workers Benefit Fund Payroll Tax

Workers Compensation Death Benefits By State Interactive Map

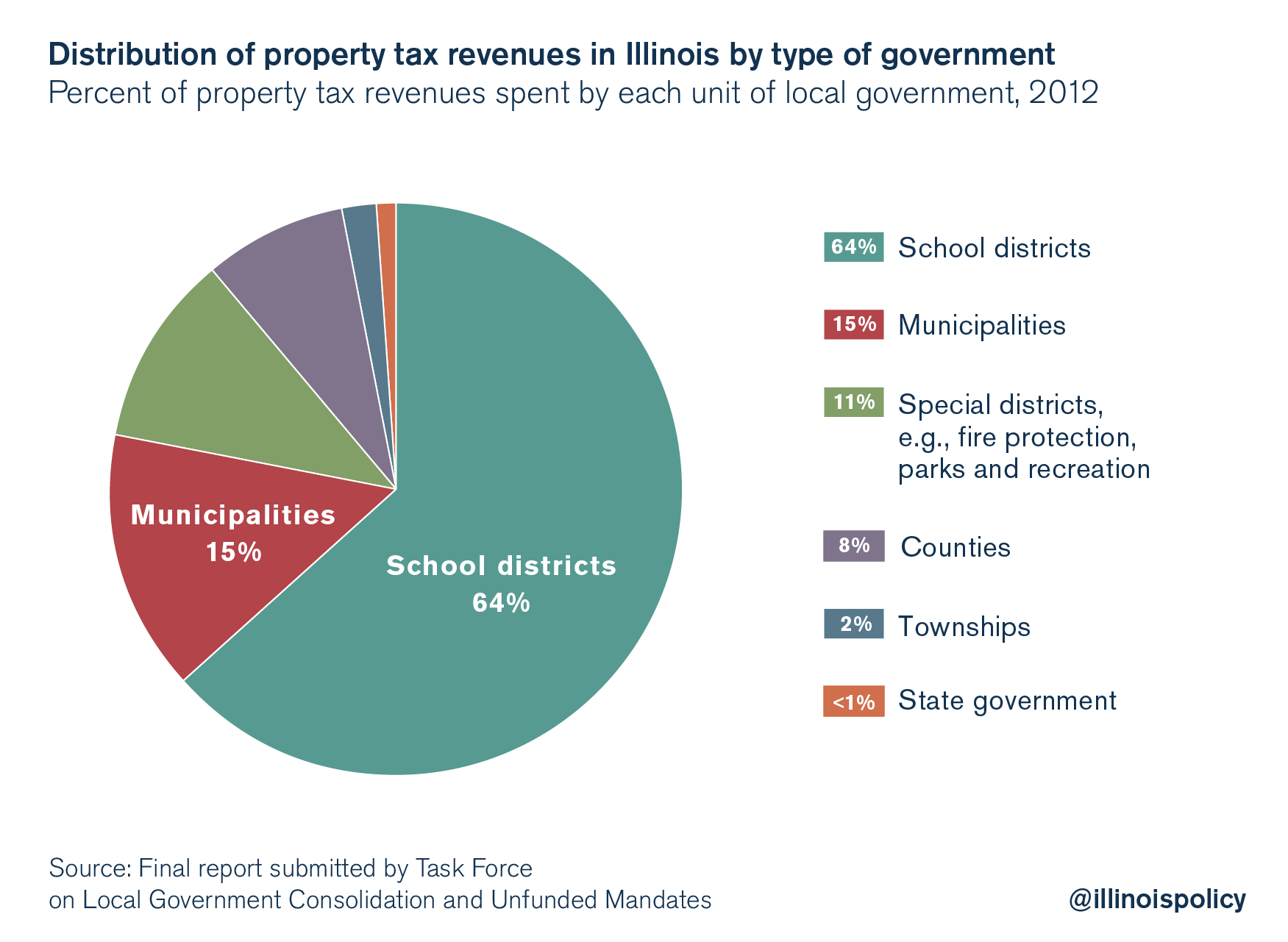

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

2021 Maximum Minimum Time Loss Rates In Wa Labor Industries Claims

Oregon Lowers Payroll Tax Rate For 2022 Local Kdrv Com

Park Development Partners Industrial Relocation Nw Indiana

Oregon Workers Benefit Fund Payroll Tax

2021 State Business Tax Climate Index Tax Foundation

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

2022 Federal State Payroll Tax Rates For Employers

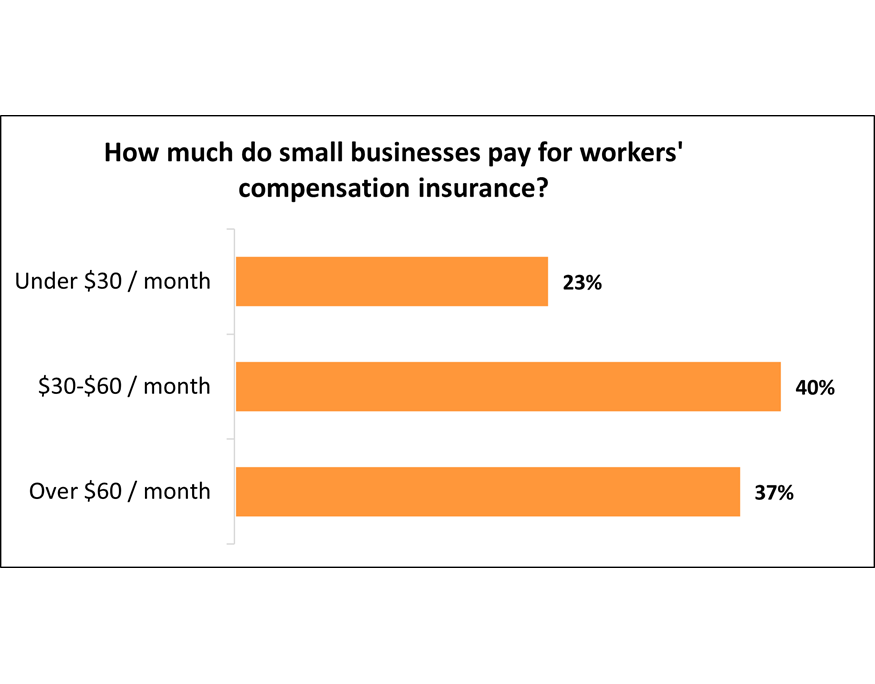

Workers Compensation Insurance Cost Insureon

Workers Compensation Costs By State

Workers Compensation Laws By State Embroker

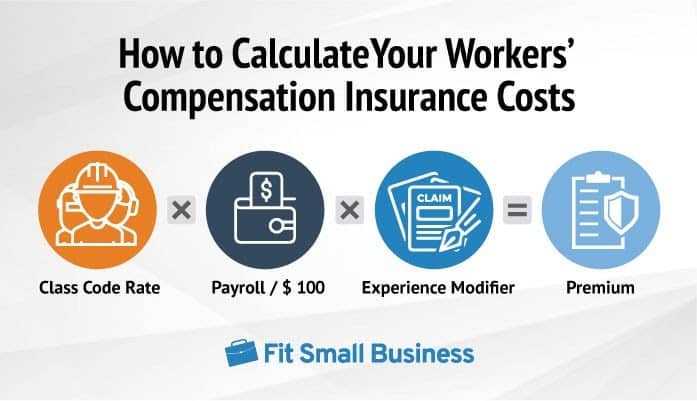

How To Calculate Workers Compensation Cost Per Employee Pie Insurance